Back in August 2020, Warren Buffett announced that Berkshire Hathaway had taken a 5% stake in five Japanese trading companies. A few weeks after the announcement, Nick Schmitz from Verdad Capital provided an excellent overview of the strategy.

Buffett’s strategy was to buy trading companies which have multiple lines of revenue. These companies are highly leveraged, but since Japanese interest rates are so low, the debt they take on didn’t cost anything. This meant that they could provide healthy dividend yields.

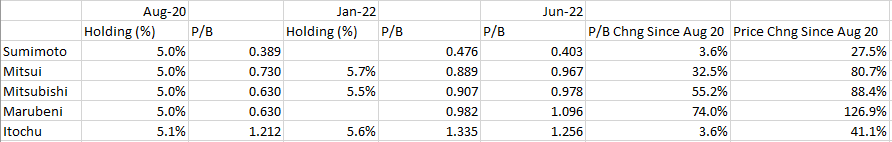

So, how are there investments looking these days? Here is a table highlighting some key metrics and how they have changed. Note, I include January 2022 data because Berkshire Hathaway’s letter to investors from year-end 2021 gives us some information on their holdings at that point in time.

As we can see, the price appreciation in these stocks has been enormous. They have been an excellent investment. The price changes also seem to have outpaced changes in the price-to-book ratios, so the repricing that has occured is not simple repricing of underlying value. There is still likely quite a bit of value left in these stocks.

That raises the question as to what Berkshire Hathaway is doing now. Given the massive price appreciation in these stocks, do they think that it is time to sell? When studying this, many investors look to Berkshire Hathaway’s yen bond issuance. They tend to issue these bonds when buying Japanese companies to hedge out currency risk. As Barron’s note:

Berkshire also issued about $1.5 billion of yen bonds during 2021, according to its third-quarter 10-Q.

This would indicate that they are buying more of these companies. Can we check this using other data? Yes, I think so. We can take the holdings of these companies published in Berkshire Hathaway’s year-end letter, adjust this for changes in the market cap of the companies and compare these changes in Berkshire’s holdings to the price changes in the stock in the same period.

As we can see, Berkshire Hathaway has been increasing its holdings at a substantially higher pace than prices have been rising. So, it appears that they are doubling down on their bet.

Is there anything that could throw this off? One thing — although it is unclear how much of a concern it should be. Namely, Japanese inflation is rising. If this continues apace and the Bank of Japan have to raise rates, the fundamentals of these companies may change due to their high debt levels.

Actually, rising Japanese inflation is a challenge to the entire market structure in Japan. Investors are currently ignoring it and have convinced themselves that Japan could never experience sustained moderate-to-high inflation. I am not sure that this is the case, but that is a post for another day.