Natural gas prices are rising. So are coal prices. Oil prices seem strangely subdued relative to historical trends, as the chart below shows.

What is going on? The markets are abuzz with rumours and charts. Discussing them all would take up too much time. Let’s take one as an example.

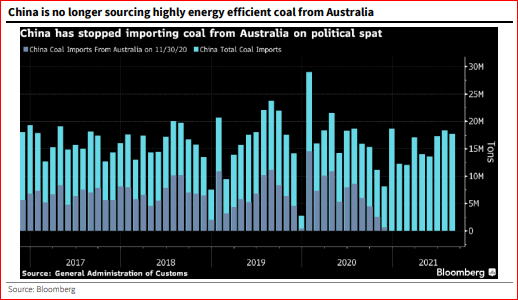

Some are pointing to the fact that China have stopped buying coal from the Australians due to a recent trade embargo put in place due to geopolitical tensions.

The problem with this narrative is that global markets are fungible. If Peter stops buying your coal, he will start buying more coal from Paul. Paul’s previous buyers will then turn around and buy more coal from you.

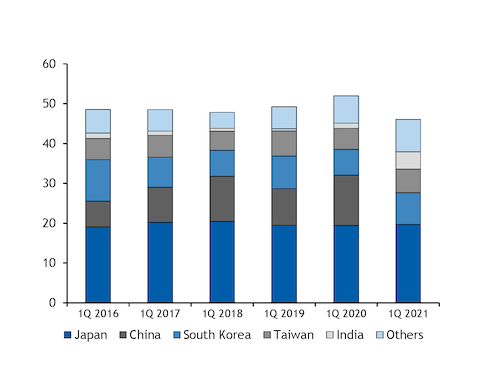

In the real world, this tends to largely work out. We can see this if we look at Australian coal exports by location.

The Chinese embargo has resulted in some disruption. But not much. Certainly not enough to cause runaway price increases.

The current run up in energy prices remind those of us with long memories of the previous run up in 2008. If you look at the narrative at the time, there were many justifications given for this run up — what strikes us today is how random they were. North Korean missile tests, Israeli-Lebonese conflicts, Hurrican Katrina — the list goes on.

In reality, however, the key seems to be Chinese demand. Since 2007-08 prices of coal and gas — energy generally — have become tightly correlated with Chinese GDP growth.

If this relationship holds going forward then something contradictory is going on in energy markets. On the one hand, energy markets are seeing prices soar on the back of a spike in Chinese GDP growth. But on the other, projections of Chinese growth in the near future are low and falling.

The only way that both of these things can be true is if the markets are saying that the correlation between Chinese GDP growth and energy prices is about to break down completely. Maybe the markets are right, but what are they basing this on? Dubious analyses of Chinese embargos of Australian coal? That seems like a stretch.

Assume then that the correlation holds moving forward. In that case we can run a simple linear projection of future coal prices using market forecasts of Chinese GDP (gas prices should look similar).

Provided market forecasts of Chinese GDP are somewhat reasonable and assuming that the correlation between Chinese GDP growth and energy prices holds, we can conclude that the present spike is likely to be temporary.

On a related note — as I have been pretty active tracking infltion risk: does this imply that inflation risks are overblown. Probably not. Consider US inflation numbers by component.

As we can see, rising energy costs are certainly giving inflation a boost. But the other components are rising anyway. Unlesss we see inflationary pressure on these components ease, inflation remains a risk. And these components are not, unlike energy, correlated with Chinese GDP.