How bad do sanctions hit Russian stocks?

And for how long?

Sabres are rattling in Ukraine. Russia has formally recognised two breakaway republics in the Donbass region. The US is saying that Russia is poised to invade the whole country.

Meanwhile Russian markets are getting crushed. At the time of writing, the MOEX is down over 38% from six months ago. That could be a great buying opportunity if it proves to be temporary.

While we have no idea whether Russia will invade Ukraine — for the record, I have serious doubts — the response to either the recognition of the two breakway republics in Donbass or a full-scale invasion should be much the same: sanctions.

Sanctions were used before, back in 2014 when the Ukraine situation first kicked off. This means that we can study the impact that sanctions actually have on Russian stock market returns.

First off we will examine whether sanctions actually lead to market declines. Since markets can be both forward and backward-looking we will take the worst day of weekly returns within a two week window, with a week forward-looking and a week backward-looking. We will also compare these returns to the worst returns on record in the full sample (2011-2022). (In the table ‘sanctions’ means the number of sanctions imposed on a given day — i.e. if the US and the EU announce sanctions on the same day there are 2 sanctions).

Okay, we definitely see an effect from sanctions. Except for one announcement in May of 2014, sanctions have coincided with substantial negative returns within a two week window.

But how bad are these declines? If we look at the worst declines on record in the data — and remember, this is only a decade worth of data and does not even include the 2008 financial crisis — we see that the declines associated with the sanctions are not all that bad.

In fact, the sanctions only make one appearence on the ‘worst of’ list, down second from the bottom. So, finding number one: while sanctions are associated with declines in the MOEX index, these declines are not the worst of the worst.

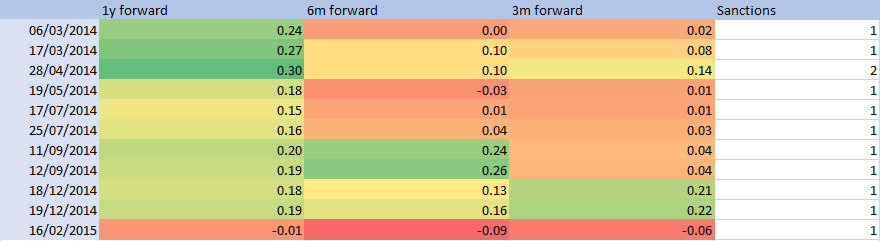

The next question is how much of an effect sanctions have on future price action. In short, if bought on the day of the sanctions announcement would you be left holding a bad investment for a protracted period? The table below shows the 1 year, 6 month and 3 month forward returns starting on sanction day.

These findings are remarkable. Far from being a bad idea to buy the MOEX on sanctions days, it is a very good idea. And the longer you hold the index, the more you reap the gains.

Those gains are phenomenonal. The average 1 year forward return if you buy on sanctions day is 19%. Now consider that the average 1 year return on the MOEX over the whole period 2011-2022 is around 10% and you realise that buying on sanctions day nearly doubles your prospects.

Finding number two: far be it from predicting poor future returns, sanctions actually predict substantially better than average future returns.

Before you go out hunting for Russian stocks, however, consider the elephant in the room in terms of risk: oil prices. Below we see that last time sanctions were imposed, the oil price also declined and this crashed the Russian rouble.

If this were to happen again, then there may be some foreign exchange risk in the Russian market. Now, most people are bullish on energy prices right now. I do not disagree with them. But is it possible that NATO could somehow get their oil producing allies to ramp up production to crash the oil price? It seems pretty unlikely to me, but it is possible.

Finally, along that line of thinking consider that there is a relationship between the MOEX itself and the oil price. The charts below show this index. (The first is the full series, the second removes the outliers).

So, in summary we can say that: if you remain bullish on energy prices in 2022 and you do not think that NATO have the capacity to use them as a geopolitical tool, then Russian markets might start looking very attractive indeed in the coming weeks and months.