How inflation is threatening to create a recession in the US

And why this puts the Fed in an even more difficult position than many think

From action in the markets it looks like investors are increasingly accepting that inflation might be sticking around. They also seem to be increasingly worried about a recession.

In normal times, these two events would be related but opposite. Inflation is seen as the result of too much demand in the economy. When demand is too high, the Fed raises interest rates and chokes the economy into a recession. Inflation falls.

But the environment in which we currently find ourselves in is not normal. Before the Fed gets a chance to choke off demand, there is evidence that the US economy may be slipping into recession of its own accord — and that this might be caused by the high inflation.

How does that work? Well, consider the recent contributions to GDP.

As we can see, the drag on the GDP numbers is coming from the trade balance. The US trade balance has deteriorated substantially in the first quarter of 2022.

At a glance it appears a very unusual deterioration. Last time we saw something like it was in the third quarter of 2020. In that quarter the economy had just reopened after lockdowns and consumption expenditures were growing at over 25%. In Q1 2022, on the other hand, consumption expenditures were not even growing at 2% a year.

What is going on here? Let us first turn to the main drivers of the trade decline. Here are the three countries that most impacted the trade balance.

Since we know that consumption itself is not driving these imbalances what else could be doing it? One obvious candidate would be relative inflation rates. Basic trade economics states that if prices in one country rise relative to prices in another, the former country will import more and export less from the latter. This is simply because their exports will be less attractive and the higher wages being driven by the inflation will drive higher imports.

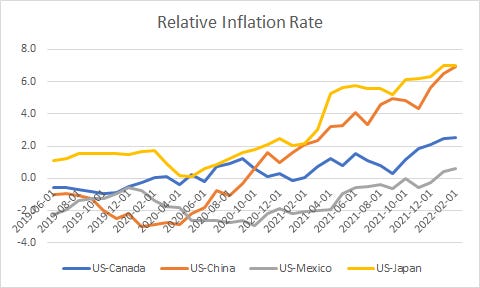

Here are the relative inflation rates for each country.

These line up perfectly with the deterioration of the trade balances in each country. China has vastly lower inflation rates than the US and the trade deficit with China has exploded. A similar story can be told for Japan.

Mexico, meanwhile, has relatively similar rates of inflation and the US has managed to increase exports to Mexico thereby mitigating some of the effects of rising imports. Canada sits in the middle. The lesson is clear: higher relative inflation rates seem to be driving the increase in the US trade deficit.

Shouldn’t the US dollar move to offset this? PPP theory states that if inflaion is higher in one country than in another, the currency in the former should fall relative to the latter. True. But the US dollar is not just any old currency. It is — for now, at least — the world’s favourite defensive currency. When fear is high, the US dollar rallies. That is what we see today, on both a real and a nominal basis.

This adds another layer to the Fed’s current problems. Inflation is creating recessionary conditions in the US by driving a detrioration in the trade balance. This means if the Fed do not respond by creating a recession themselves — one that may drive down inflation — the inflation may create the recession itself. Deep stagflation.