With inflation rising there is plenty of talk about finding ways to invest that can (a) protect wealth against rising prices and (b) perhaps eke out something resembling a real return.

If this inflation sticks expect this to become the theme of the 2020s. Whereas the 2010s were all about deflation risk and low yields, an inflationary 2020s will — explicitly or implicitly — be all about wealth retention and real returns.

One very simple option on the table is to invest in robust currencies. One that immediately springs to mind is the Swiss franc.

Being a notorious bunch of anti-inflationists, there should be a link between inflation and the franc. Here is a simple regression of the data since 2008.

Well that doesn’t look great. Maybe we’re wrong about the franc after all?

Actually, if you recall what happened in this period you’ll know that the Swiss National Bank (SNB) bought enormous amounts of euro in the FX markets. They did this because the sovereign debt crisis in Europe was sending large flows of capital into Switzerland. This was driving up the franc’s value. Since this decade was deflationary and low growth, and since this was crushing Swiss exports, the SNB put a lid on the franc.

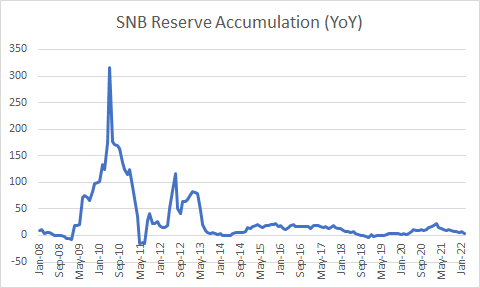

Here is annual change in reserve accumulation at the SNB.

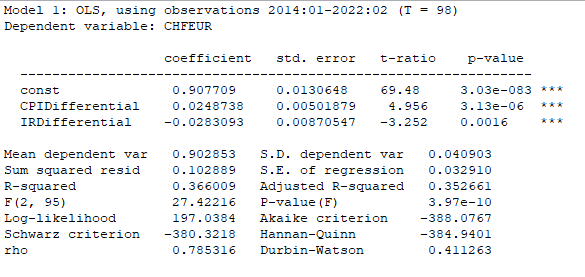

Okay, so maybe we should just strip out all the data pre-2014. Let’s try a simple regression with that.

Now this is much more promising. We should take a quick note here of an interesting phenomenon. The orange dots are the past five months. As we can see they have drifted far off the regression line. This is leading to us getting a better fit with a polynomial model than with a simple linear one.

How do we interpret this? I think it is likely that this drift off the line is due to what we might call ‘inflation hesitancy’ in markets. Until very recently markets and central banks have been adament that inflation was transitory. So, it is not surprising that markets have been less inclined to price the heavy inflation we have seen into the franc’s price. If the inflation sticks around expect this to change. That could mean a sharp appreciation in the franc.

Out of interest, does the model improve if we add a carry component?

Yes, indeed it does. This is important because there is good reason to suspect that the ECB and SNB could take different paths when it comes to rate hikes. So, if you are interested in CHF/EUR keep an eye on this.

That’s all very nice, but has it worked? Has an investment in CHF/EUR allowed investors to dodge inflation.?Here are returns since November broken down into inflation and real return.

I’d say that the CHF/EUR has done pretty well. It has certainly protected wealth. And in recent months it has even thrown off some real returns. If our analysis about ‘inflation hesitancy’ in markets is correct and if the consesnsus shifts to recognising the present inflation as real and sticky, we may even see those real returns rise as the franc moves to price the present inflation differential properly.

So what is the key risk? Simply that the SNB might intervene again and put a ceiling on the franc. This would certainly be a case of fighting the last war. A strong franc helps the SNB keep inflation down without the need to raise rates and risk recession.

But doesn’t a strong franc damage Swiss exports? Not necessarily. If prices are rising faster in Europe, wages will likely rise faster too. This means that Europeans will have more nominal purchasing power to buy Swiss exports. A rising franc will simply hold Europeans’ real purchasing power relative to the Swiss export market constant. This is how flexible currencies are supposed to work.

But the SNB may screw it up. There may be policy inertia present, where every problem is tackled in the same way as the previous problem, even if they are fundamentally different. I have no insight into that. If you’re worried best to give the SNB a call!