Natural Rate of Interest in Crisis

Just before the holidays I wrote an article for Newsweek arguing that the official basis for Federal Reserve policy was at risk of coming unwound due to the present uptick in inflation. My basic argument was that the Fed and other central banks act as if they have some ‘objective’ criteria for setting interest rates while in the real world they are constantly worrying about upsetting financial markets. This leads them to the Catch-22 position today: should they raise rates to fight inflation and risk a market crach? Or should they sit on their hands, allow markets to march ever higher and risk being blamed for inflation?

The framework for understanding monetary policy in this way is laid out in an essay I published last year in the scientific journal Inference Review, entitled Monetary Faith. In it I argue that there is no solid relationship between the central bank interest rate and any real macroeconomic variable — say, savings or investment. Rather the central bank interest rate is watched, not by CEOs and entrepeneurs, but by financial markets participants — who, frankly, have turned the central bank interest rate into a cultic object of worship in the past 30 or so years.

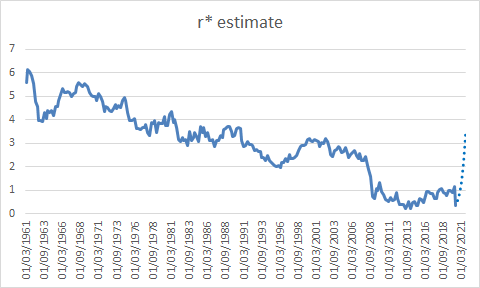

So, back to the natural rate of interest. Firstly, I should say: I know that the Fed and other central banks do not set the rate of interest in line with estimates of the natural rate — the so-called ‘r*’. That said, the theoretical framework behind the r* is supposed to guide central bank policy. It is worth looking at what is going on with the r* today.

The first thing to note is that the New York Federal Reserve — who published r* estimates — ceased publishing them in Q2 2020. On their wesbite they write:

Owing to the extraordinary volatility in GDP related to the COVID-19 pandemic, we are suspending until further notice the posting of regular updates of the LW and HLW model estimates. (November 30, 2020)

I do not understand this, to be honest. They could easily smooth out their GDP series in order to continue to publish estimates. But regardless, we can still play around with their data and take a stab at how the r* is behaving. First of all, let us look at the r* estimates up to Q2 2020 together with the inflation-adjusted Fed funds rate.

We can already see the divergence taking place as the real Fed funds rate goes deeply negative.

Next let’s take a guess at where the r* estimate is headed. To do so, I first assume that the r* estimate will rise. I assume this because the r* is driven in the model by the output gap. Since the US now has a very tight labour markets and rising inflation, I assume that the output gap has gone negative.

My second assumption is that the r* is going to rise quite quickly, given the sharp outburst of inflation. To capture this I look at the top ten times in history that the r* has risen, I take the average growth rate and I apply it to the data from Q2 2020 to Q3 2021. Here is what I get:

This estimate — or rather: guesstimate — then allows us to look at how the real Fed funds rate is beahving relative to the natural rate estimates. To do this, we simply subtract the real Fed funds rate from the r* estimate. I call this the ‘r* gap’ and it shows how much the Fed would need to raise the real interest rate to achieve the current estimated r*.

A few things stand out from this exercise:

We have never seen the r* gap rise as quickly as it is rising today; it has risen 650 basis points in only three quarters

The closest analogous event was in the period 1973-1975 when it rose around 610 basis points in five quarters.

In the early-1970s Fed policy was not as strongly tied to inflation control as it was today and no r* estimates were being published; this is important because the rising r* gap is arguably more ‘relevant’ for central bankers today than it was in the early-1970s.

The last time we saw the r* gap close when it was this large was during the Volcker Shock in 1980-81.

Between Q3 1980 amd Q2 1981 the Fed raised the funds rate from 9.8% to 17.8%.

So, what the data is telling us is that inflation continues and the Fed wants to take their natural rate of interest framework remotely seriously, they may soon be facing down raising rates as vigorously as Volcker did in 1980-81 (albeit from a much lower base).

The problem with doing so is obvious: in 1980-81 the financial markets were not firmly welded to the central bank interest rate; today they are. Financial markets today are very far overextended. The guys at Verdad Capital and I published a short piece highlighting these excesses at the beginning of December. Any Fed rate hike could crash these markets. But a Volcker style shock would almost certainly demoliish them completely.

The markets remain oblivious to this possibility. Right now the Fed are clearly sitting on their hands. But how long can they ignore this? A December poll showed that 56% of Americans believed that inflation was causing them major or minor financial stress, with 28% saying they felt major pressure. It is well known that President Biden’s poll numbers are in the gutter. At some point, the Fed must feel this pressure.

Then there are the markets. Market participants are almost schizophrenic about interest rates. On the one hand, they speak of rising interest rates with fear and trembling; they might precipitate a market crash, after all. But on the other, they complain endlessly about low interest rates making asset allocation impossible. We few more months of deeply negative interest rates may well push market participants more so toward the latter view.

On top of all this, raising interest rates may not even stamp out the inflation. I believe that the inflation is a result of massive supply side disruptions caused by the response to the pandemic. Raising rates and creating a recession may ease these pressure; but it may not. We simply do not know. But regardless of this, all of the above holds so long as the Fed upholds their inflation control mandate. I raise the matter here only to highlight how bad a situation this is — for everyone involved.

Yikes.