Russia's current account: worst case scenario

If the EU managed to completely end Russian energy imports would this crash the Russian current account?

This is a short supplementary post to yesterday’s post on the impact of rising oil prices on the Russian current account. (I also published a more popular piece on this at UnHerd today which is worth a look because I consider the geopolitical ramifications of these policies).

Okay, but let’s give the case for sanctions an absolute best case scenario. I mean in terms of the capacity to sanction and the capacity of the sanctions to work. Here are the assumptions we will make:

The EU, which is Russia’s largest trade partner, completely halts imports of energy products — that’s €62bn worth (billion, with a ‘b’!).

Russia completely fail to sell any of this oil and gas in other markets — the €62bn in demand just evaporates from their current account.

Russian imports from the EU continue apace, as do income payments on Russian investments to the EU.

So, this would be a dream scenario for a sanctioner. But now that we have wiped out, oh, 25% of the EU’s energy supply, we must assume that oil prices might rise a bit. Again, let’s be insanely generous:

This causes oil prices to rise to $220 a barrel by the end of 2022.

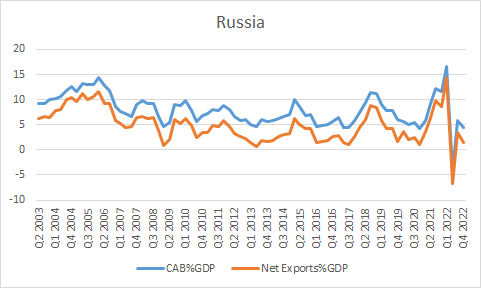

Now, here’s the question: does the now-raised price of oil cancel out the fall in actual barrels sold for the Russians? Here is the current account balance and net exports that I get when I run these assumptions through my model:

Here we see that the trade balance goes negative for one quarter. This is because I have assumed that oil prices rise gradually and only hit $220 in the last quarter of the year. But once these prices start reaching their equilibrium point, the trade balance goes positive.

Conclusion? Even on these extremly generous assumption, the EU ending energy imports from Russia would be largely balanced out by the increases in the price of oil sold elsewhere.

But of course the assumptions are far too generous. In reality:

The sanctions would be ‘leaky’; trade would continue at a lower level.

Russia would offload a large amount of these energy exports into other markets, especially as oil prices rise.

Russia would probably respond to these actions by halting EU imports.

The EU has just wiped out 25% of its energy supply; oil would climb much higher than $220 a barrel — how high? $250? $280? $300? This would be an unprecedented action; choose your poison.

Plug more realistic assumptions into the model and you would see the ban positively impact the trade balance.