The oil price and the rouble

Can the West crash the oil price and will this wreak havoc on the Russian economy?

Earlier this week I wrote a piece for UnHerd arguing that sanctions would be largely ineffective against Russia — at least, from a macroeconomic point-of-view. In that piece I argued that the only way that the West could ‘punish’ Russia for an invasion of Ukraine would be to bring oil prices down. Now that the invasion appears to be happening, it is worth following up on that as the implications for market are obviously profound.

The first question is this: is it true that the West crashed the oil price in 2014 when tensions in Ukraine began? This claim was widespread at the time (see also: this). Looking at the data, it is impossible to tell. But there are some indications that the claim may have some merit to it. Here is Saudi oil production versus the oil price:

First off, note that they are somewhat correlated. More on that in a moment. Note that the Saudis do ramp up oil production in the first quarter of 2014 (the Ukrainian-Russian conflict kicked off in February 2014). This increase in Saudi production — which may or may not have been requested by the United States — seems to precipitate a collapse in the oil price.

But when we zoom out, it doesn’t look like they increased production all that much. That said, it is possible that the oil market was fragile at the time. To understand this, lte’s build a model that tries to explain the oil price. We’ll keep things simple enough. We’re going to run a regression explaining price changes by a) Saudi oil production changes and b) the economic growth rates of all OECD countries. Here are the results:

Okay, so the model works. But look at the R-squared. It’s not a bad fit, but its not great. These variables only explain around 32% of oil price changes. What we gather from this is that the oil price is a very complicated variable. This is an untidy conclusion, but it is the truth.

So, did the Saudis really crash the oil price at the request of the United States to punish Russia in 2014? Maybe.

We should finally note, however, that in the past two quarters the Sauids have ramped up production again and we have not seen a decline in the oil price. Maybe they could ramp up oil production more and we would see an effect, but the evidence — uncertain though it is — leads to the opposite conclusion.

Now let’s move on to the rouble. Here we can say something a bit cleaner. Below is a regression on the Russian Real Effective Exchange Rate (REER) and the Brent oil price.

Recall that the REER control for inflation. Inflation will have effects of its own on the exchange rate as per the Purchasing Power Parity (PPP) effect. What this regression tells us is that abstracting from inflation, the rouble is largely determined by the oil price.

But now from a tidy conclusion we move toward another untidy one. Whether the United States and the Saudis engineered an oil price crash in 2014 is an open question. But what it did to the Russian economy is not. The rouble almost halved in value. Inflation spiked. Interest rates rose. The Russian economy sank into recession.

True, this impact was short-lived. But it was visible and it hurt. It was not short-lived for investors in Russian securities, however. The rouble never gained back its ground and so holders of Russian securities took a large foreign exchange hit.

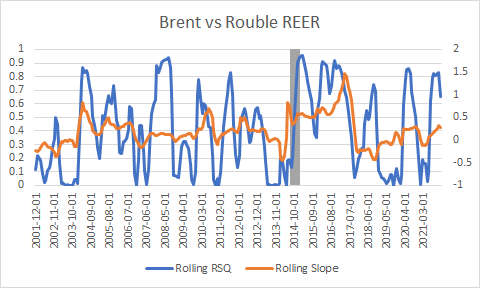

So, if we assume that the West can engineer an oil price collapse once again — an assumption that I am not inclined to accept — can we be confident that this will lead to a collapse in the rouble as bad as the one we saw in 2014? The best way to look at this is take a rolling 12-month regression of the oil price versus the rouble.

We get somewhat annoying results. I have highlighted the period of the rouble crash in grey. Note that just before this, the slope of the regression increases massively. This means that, just before the collapse of the rouble collapse of 2014 the sensitivity of the currency to the price of oil increased substantially. Why? I do not know.

If the oil price collapsed and the current relatioship between the two variables (i.e. the slope) held then we would not see as dramatic an impact of the oil price on the rouble. But the data shows that the slope of the line changes from time to time. And if you squint you could argue that these changes take place when there is dramatic activity in the oil market.

Therefore, we are left in the somewhat unfortunate position of having to guess how the slope might react if there were an oil price collapse.

You can draw your own conclusions from that data. I come to the following conclusions — albeit while recognising that these are highly uncertain:

There is good reason to think that, even if the Saudis did engineer the oil price crash in 2014, we are in a different world right now and there is no reason to think that they could do so again.

There is no doubt that the oil price drives the rouble, but it is unclear if an oil price decline would have as large an impact on the currency as it did in 2014. This especially so because the oil price had been riding high for years back then, but has been low for years this time around. This implies that the Russian economy and currency is not as dependent on high oil prices as they were back then.

This puts investors in an unfortunate position. If you that the above conclusion is true — and again, I think it is the strongest interpretation of the data but it is still highly uncertain — then Russian stocks will be a massive opportunity in the coming weeks. If you think that it is false, you are taking enormous foreign exchange risk in these equities, even if you buy them at knockdown prices.

And then there is the possibility that the coming sanctions are so severe that they ban Westerners from owning equities outright. But I would hope this possibility will become clear in the coming weeks.