The Brazilian economy has had a tough couple of years. When commodities prices took a dive in the mid-2010s the Brazilian economy entered into stagnation. Unemployment rose from around 6.5% to around 12%.

Policymakers assured themselves that, although this was not ideal, at least they were not experiencing inflation and currency crisis. After all, these had been the historical ills of the Brazilian economy.

Yet, as the economy sank into stagnation and the government refused to engage in activist fiscal policy inflation, after an initial jump, sank down to historically low levels. But since the pandemic, this has changed and inflation is now riding high at around 10%.

Typically when inflation is high in Brazil, the central bank raises interest rates to dramatically defend the currency. But this has not been the case this time around.

Why is this? To understand it we must step back for a moment and understand what drives the Brazilian real.

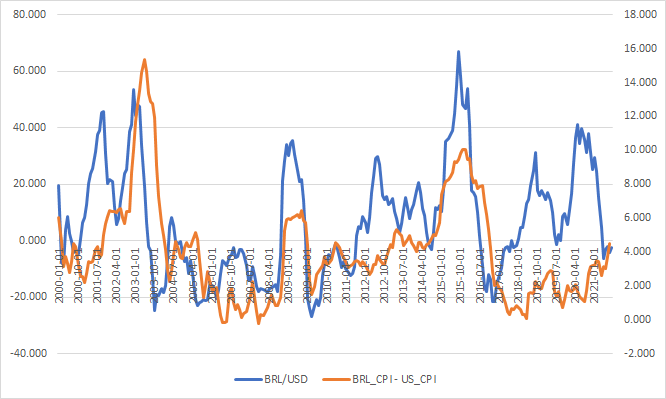

The following chart plots the Brazilian real-US dollar exchange rate against the Brazilian inflation rate minus the American inflation rate.

As we can see, the two are strongly correlated — at least until the end of 2015. This correlation can be seen as an OLS model at the bottom of this post (Model 1).

Why does the correlation break down in 2015? Why does the real experience substantial volatility in the period 2016-2021 despite Brazilian CPI being relatively low?

This brings us back to where we started. Recall we said that the Brazilian economy fell into stagnation after the collapse of global commodities prices? Well, that gives us a clue as to what was driving currency volatility in this period: the price of iron ore.

Iron ore is Brazil’s key export — they sell it mainly to China and it has come to have a huge impact on the real. We can see the negative correlation between the two variables in the chart below.

More formally we can run a multivariate OLS model to show this (at the bottom of the post, Model 2). This OLS model shows that between 2016 and 2021 relative inflation stopped having a statistically significant impact on the real. But the iron ore price in this period did have a statistically significant impact.

What this means is that, during this low inflation period, the real was getting whacked by the iron ore price volatility. This explains why the central bank were willing to lower interest rates during this period despite the currency volatility: they knew that they could not control the impact of the iron ore price on the currency and so they lowered interest rates to try to lift the economy.

But this does not mean that inflation ceased having an impact on the real. Inflation was flat. So no impact will show up in our OLS models. But inflation almost still will have an impact on the real if it starts rising seriously.

We saw some impact on the real already during 2020. But it has since eased. This is because, although Brazilian inflation is running high, so is US inflation. Since the impact comes through relative inflation rates, this is easing the pressure on the real.

But should we bet that these relative rates will remain stable? It seems more likely that, if global inflationary pressures continue to build, Brazil will experience higher rates of inflation than the US. After all, emerging markets always experience relatively higher rates of inflation — and if inflation is rising everywhere the ‘inflation spread’ should widen too.

If this prognosis is accurate, it means that the Brazilian bond market is living on borrowed time. If relative inflation rises in Brazil, the old pressure it has always exerted on the real will reemerge. At that point, the Brazilian central bank will have to recognise that they are no longer dealing with uncontrollable iron ore prices and they will have to pivot to raising interest rates.

Given that the impact of interest rates on currencies is also relative, we must also take into account that if inflation in the US does not cool down we will likely see interest rate increases there too. That means that the Brazilian central bank will have to raise rates even higher to get the same effect on the real.

Perhaps the present inflation cools down soon. But if not, Brazilian financial markets will be worth watching carefully.

___________________________________________________________

Model 1: OLS, using observations 2000:01-2015:12 (T = 192)

Dependent variable: FX

coefficient std. error t-ratio p-value

---------------------------------------------------------

const −10.8394 2.19194 −4.945 1.67e-06 ***

RelCPI 3.67996 0.404417 9.099 1.24e-016 ***

Mean dependent var 5.677728 S.D. dependent var 20.34714

Sum squared resid 55074.51 S.E. of regression 17.02545

R-squared 0.303517 Adjusted R-squared 0.299851

F(1, 190) 82.79923 P-value(F) 1.24e-16

Log-likelihood −815.6951 Akaike criterion 1635.390

Schwarz criterion 1641.905 Hannan-Quinn 1638.029

rho 0.932256 Durbin-Watson 0.141134

___________________________________________________________

Model 2: OLS, using observations 2016:01-2021:08 (T = 68)

Dependent variable: FX

coefficient std. error t-ratio p-value

-------------------------------------------------------

const 13.2963 3.39988 3.911 0.0002 ***

RelCPI 0.381809 0.814455 0.4688 0.6408

IronOre −0.162105 0.0525779 −3.083 0.0030 ***

Mean dependent var 10.19471 S.D. dependent var 17.09361

Sum squared resid 16970.89 S.E. of regression 16.15830

R-squared 0.133113 Adjusted R-squared 0.106440

F(2, 65) 4.990480 P-value(F) 0.009633

Log-likelihood −284.1592 Akaike criterion 574.3184

Schwarz criterion 580.9770 Hannan-Quinn 576.9568

rho 0.908376 Durbin-Watson 0.136227