What Drives the Australian Dollar?

I’m laying out some quantitative work here today that may be of general interest. It is probably the first in a series of (at least) two pieces on the Australian economy as I am doing research for an essay I am hoping to get commissioned for a magazine. The following is a pretty technical piece. So, apologies for those bored by this sort of thing.

My concern is that, because Australia has been so aggressive in their response to COVID-19 and since the seasonal delays between Europe/US and Australia led policymakers there to embrace an effective zero-COVID policy (because the seasonal delays created an illusion that their aggressive policies were working), the damage done to the Australian economy could be worse than was done to other developed countries.

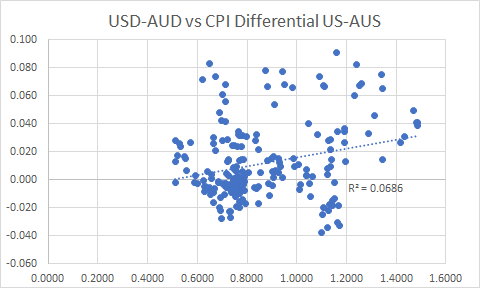

With that said, let’s have a look at what drives the Australian dollar. The first port of call should be trying to find a basic Purchasing Power Parity (PPP) relationship. If PPP holds then the AUD-X should be determined by the inflation differential between Australian inflation and inflation in country X. Does this work?

No, it does not. PPP does not hold for the Australian dollar. (At least when comparing it to the US dollar; it may work on other currency pairs, but that doesn’t concern me).

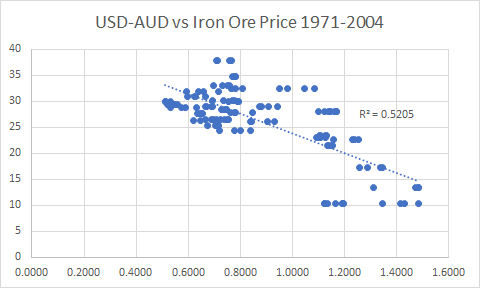

What does work then? Fishing around and testing my intuitions, I found three variables: the iron ore price, Australian inflation and US inflation. Let’s start with iron ore, because it is an interesting relationship. Here are the correlations divided between pre-2005 and post-2005.

As the reader can see, the correlation flipped. Pre-2005 a higher iron ore price was associated with a stronger Australian dollar. Post-2005 a higher iron ore price was associated with a weaker Australian dollar.

The post-2005 relationship seems pretty weird. After all, shouldn’t a rise in the price of Australia’s biggest export support the value of the currency? And didn’t iron ore become more important for the Australian economy around 2005? Let’s dig in a bit more before we try to draw any conclusions.

As I said, both Australian and US inflation also explain the AUD-USD currency pair. Here is the output of a multiple linear regression to give us a sense.

Model 1: OLS, using observations 1971:1-2021:3 (T = 203)

Dependent variable: USDAUD

coefficient std. error t-ratio p-value

---------------------------------------------------------

const 0.645733 0.0188229 34.31 9.95e-086 ***

USCPI 3.06083 0.566474 5.403 1.85e-07 ***

AUSCPI 1.95926 0.410663 4.771 3.53e-06 ***

Mean dependent var 0.865556 S.D. dependent var 0.222252

Sum squared resid 4.899697 S.E. of regression 0.156520

R-squared 0.508948 Adjusted R-squared 0.504038

F(2, 200) 103.6445 P-value(F) 1.30e-31

Log-likelihood 89.94479 Akaike criterion −173.8896

Schwarz criterion −163.9500 Hannan-Quinn −169.8684

rho 0.949989 Durbin-Watson 0.092711

Obviously Australian and US CPI are themselves correlated (R^2 of 0.56 for those interested). Looking at the coefficients, however, it appears that US CPI is the bigger driver.

This means that if inflation rises in either country — but especially in the US — then the Australian dollar tends to lose value. So, when global inflation is afoot — as it is today — this should be bearish for the Australian dollar.

What about iron ore? Does it add ‘information’ in the regression and therefore is it operating on the currency independently of inflation?

Model 2: OLS, using observations 1971:1-2021:3 (T = 203)

Dependent variable: USDAUD

coefficient std. error t-ratio p-value

--------------------------------------------------------------

const 0.554248 0.0266754 20.78 9.69e-052 ***

USCPI 3.13493 0.539795 5.808 2.48e-08 ***

AUSCPI 2.47450 0.406661 6.085 5.88e-09 ***

IronOrePrice 0.00119312 0.000257600 4.632 6.54e-06 ***

Mean dependent var 0.865556 S.D. dependent var 0.222252

Sum squared resid 4.422907 S.E. of regression 0.149083

R-squared 0.556732 Adjusted R-squared 0.550050

F(3, 199) 83.31294 P-value(F) 5.90e-35

Log-likelihood 100.3360 Akaike criterion −192.6719

Schwarz criterion −179.4191 Hannan-Quinn −187.3104

rho 0.935641 Durbin-Watson 0.124768

Yes it is. It is statistically significant and it adds to the fit slightly. (Ignore the coefficeint this time; the iron ore price is not being measured as a % change while CPI is).

But it does not add all that much. This clears up the first regression we ran somewhat1. The Australian dollar is first and foremost impacted by inflation. But we must be clear here: it is not impacted by the inflation differential as the PPP theory would have it. Rather it is impacted by global inflation.

This is enormously important. Why? Because if PPP held then if the Reserve Bank of Australia (RBA) could keep inflation lower in Australia than it is in the rest of the world, they could in theory determine the value of the currency. But instead the currency is tied to global inflation. The RBA have no control over that.

I suppose at this point we might mention that global inflation is afoot. Bad news for the Australian dollar, if this relationship holds up.

For completists, the relationship between US CPI and the iron oire price is statistically significant ***, low R^2 (0.11) and the coefficient is negative. This last part probably explains the strange results we got when looking at the impact of the iron ore price on the AUD post-2005.